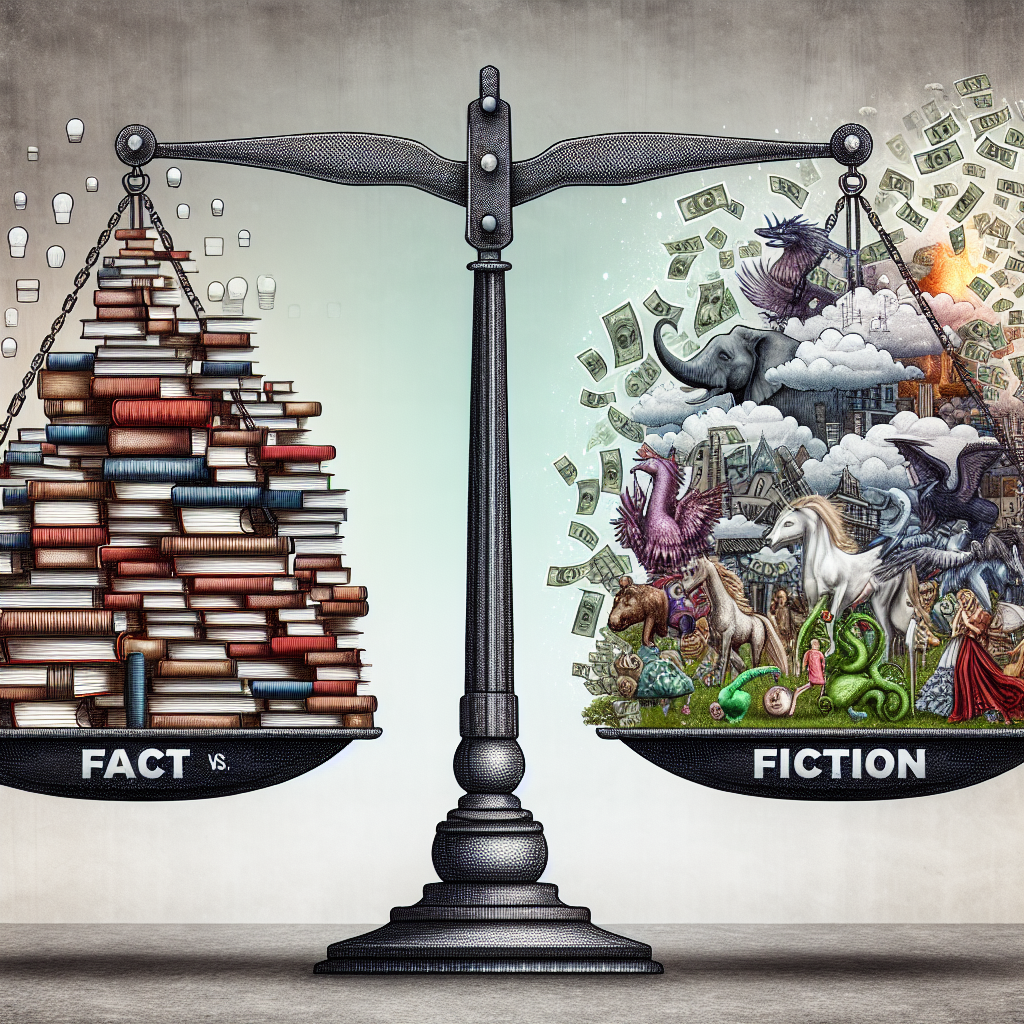

**New York, NY—** In the convoluted world of healthcare and eldercare, myths about funding for skilled nursing facilities abound, leaving families confused and often misinformed about their options. As the aging population grows, understanding the financial avenues available for long-term care is more crucial than ever. Business Insider takes a deep dive into the realities of skilled nursing funding, debunking common misconceptions and shining a light on the facts.

One of the most pervasive myths is that Medicare will cover long-term stays in skilled nursing facilities indefinitely. The truth, however, starkly contrasts this belief. According to the Centers for Medicare & Medicaid Services, Medicare only covers short-term stays in skilled nursing facilities, typically up to 100 days after a qualifying hospital stay, with conditions and limitations on the coverage. After this period, individuals are responsible for all costs, unless they have additional insurance or qualify for Medicaid under their state’s rules.

“Many families come to us under the impression that their loved one’s long-term care is fully covered by Medicare, only to face unexpected financial pressures when they learn that isn’t the case,” says Jane Doe, a director at a leading skilled nursing facility. This misconception can lead to hasty decisions and a scramble for alternative funding options when time is of the essence.

Another myth that needs busting is the belief that Medicaid is only for the very poor. In reality, Medicaid can become a pivotal funding source for long-term care for middle-class families as well, especially after personal savings are depleted due to the high cost of care. Each state has its own criteria for Medicaid eligibility, including income and asset limits, but there are legal strategies, like asset protection trusts, that can help individuals qualify while preserving wealth for their heirs.

Private long-term care insurance is another avenue, though it’s not as commonly utilized as it could be, possibly due to its reputation for being expensive. While premiums can be high and policies complex, for those who planned ahead, it can significantly alleviate the financial burden of skilled nursing care.

Veterans may also find solace in benefits they may not realize they’re eligible for. The Department of Veterans Affairs offers benefits that can help cover the cost of long-term care in specific circumstances. However, navigating VA benefits can be complex, and many families are unaware of the potential help available to them.

As the demographics of the United States shift towards an older population, the need for clear, accurate information about funding skilled nursing care has never been more apparent. By dispelling myths and understanding the facts, families can plan better and make more informed decisions for their loved ones’ care.