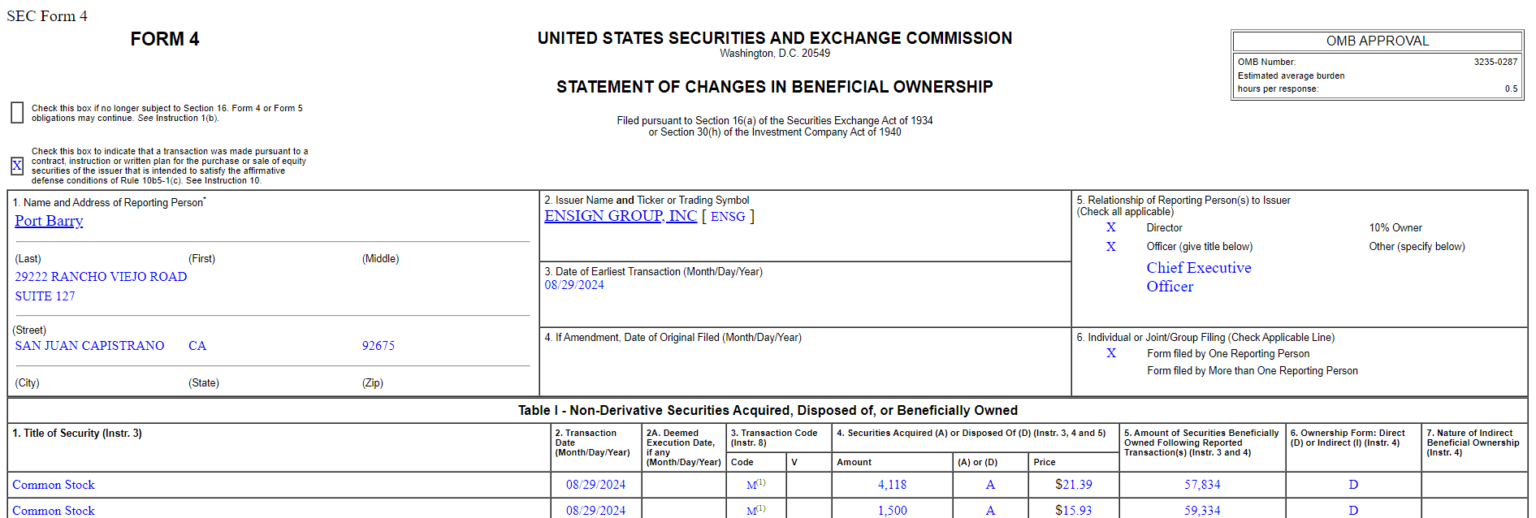

SAN JUAN CAPISTRANO, CA – The Ensign Group, Inc. (NASDAQ: ENSG) has recently attracted attention for both its significant expansion efforts and the timing of stock sales by its CEO, Barry Port. On August 29th, Port sold 5,618 shares of Ensign stock at an average price of $150.00, resulting in approximately $842,700 in proceeds. This transaction followed earlier sales, including 3,500 shares on August 22nd and 3,000 shares on August 6th, totaling over $1.7 million.

These stock sales occurred shortly before Ensign announced its acquisition of eight skilled nursing facilities—seven in Colorado and one in Kansas—effective September 1, 2024. The proximity of these sales to the company’s major acquisition news has sparked interest among market watchers. However, it is important to emphasize that there is no evidence to suggest any impropriety, and executive stock sales are often planned in advance as part of routine financial management.

Strategic Expansion Across Colorado and Kansas

Ensign’s recent acquisitions include:

- Pelican Pointe Health and Rehabilitation Center in Windsor

- Riverbend Health and Rehabilitation Center in Loveland

- Broadview Health and Rehabilitation Center and Westlake Lodge Health and Rehabilitation Center in Greeley

- Linden Place Health and Rehabilitation Center in Longmont

- Desert Willow Health and Rehabilitation Center in Pueblo

- Junction Creek Health and Rehabilitation Center in Durango

Additionally, the company acquired Prairie Ridge Health and Rehabilitation in Overland Park, Kansas. These acquisitions align with Ensign’s long-term strategy to expand its presence in the healthcare sector, increasing the company’s total operations to 323 facilities ac10ross fourteen states.

Financial Performance Amid Leadership Moves

Despite the CEO’s recent stock sales, The Ensign Group has reported strong financial results, including a 12.5% increase in revenue year-over-year for Q2 2024 and a rise in same-store occupancy to 80.8%. This performance prompted the company to raise its annual earnings guidance to between $5.38 and $5.50 per diluted share, with revenue projections now between $4.20 billion and $4.22 billion.

The stock continues to perform well, trading near its 52-week high of $151.74. While the timing of Port’s stock sales may seem noteworthy, there is no indication that these transactions are connected to any insider knowledge or concerns, and such sales are often scheduled in advance under trading plans that comply with regulatory requirements.

Institutional Confidence and Analyst Outlook

Large institutional investors, including Vanguard Group Inc. and Dimensional Fund Advisors LP, maintain significant stakes in The Ensign Group, signaling confidence in the company’s strategic direction. Analysts have generally remained positive, with many maintaining a “buy” rating due to the company’s strong fundamentals and ongoing expansion efforts.

Looking Forward

As The Ensign Group continues its expansion into new markets, including potential growth in states like Tennessee, the company remains a strong contender in the healthcare industry. While the recent stock sales by the CEO have drawn some attention, the company’s overall growth trajectory and financial health remain robust. Investors will likely continue to monitor these developments, recognizing that executive stock sales can be routine and are not necessarily indicative of broader trends.